Over the past two years, we've seen incredible growth in big tech—Meta's valuation alone is up 50% this year to date! The rest of the so-called Magnificent Seven — including Apple, Alphabet (Google), Amazon, Microsoft, NVIDIA, and Tesla have faced some similar trajectories. The question on everyone's mind is: how long can it continue? What will happen next?

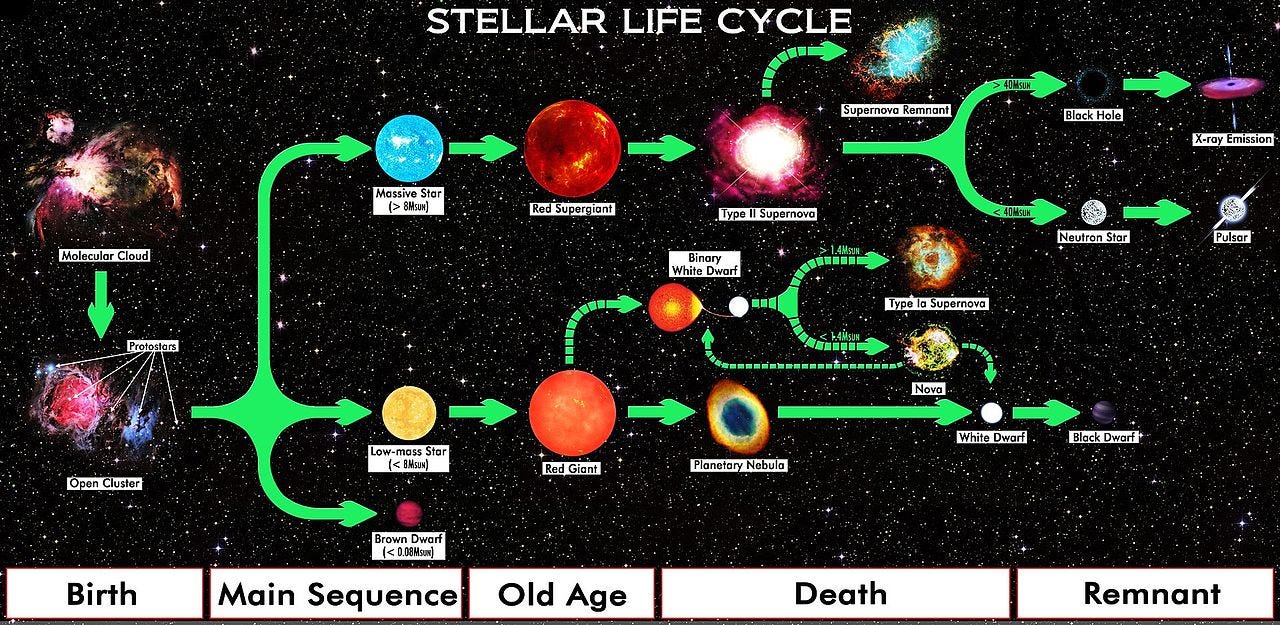

We dive into why these tech stars have skewed stock markets via an astronomy lesson, then consider how far can they go before something gives. Will we see a sudden implosion, a gradual slowdown, or perhaps an entirely new path forward? There are more than a few things these companies have in common with astronomy’s red giant stars.

This post is an illustrated companion guide to our longer piece on The Economy Explained & Our Election Outlook. Let’s compare the parallels between cash-rich tech giants and red giant stars to see where we land.

Make sure to read through the images because that’s where you’ll find the bulk of insights in the first half of this post.

Joining us from LinkedIn? Skip further below for our guide to lessons from past tech stars!

1. Central Dominance and Expansion:

A few large tech companies, such as Apple, Microsoft, Alphabet (Google), Amazon, and Meta, have grown to dominate major stock indices like the S&P 500 and NASDAQ. Their sheer size means that their stock performance heavily influences the overall market. As these companies have consistently delivered strong financial results, their stock prices have surged, causing the indices to rise even when other sectors might not be performing as well.

The success of these tech giants has led to high valuation multiples, sometimes disconnected from traditional metrics like price-to-earnings (P/E) ratios. Investors are willing to pay a premium for their stocks, driving up valuations across the tech sector and contributing to an overall increase in market valuations.

2. Resource Consumption & Buybacks:

Many of these tech giants are cash-rich, with significant amounts of cash on their balance sheets. They have used this cash for massive stock buyback programs, which reduce the number of outstanding shares and often boost stock prices. This has further amplified their influence on the market, as buybacks can artificially inflate Earnings Per Share (EPS) and stock prices.

3. Impact on Surrounding Environment:

Institutional and retail investors have increasingly favored these tech giants, viewing them as safe bets due to their strong balance sheets, consistent revenue growth, and dominance in their respective markets.

4. Eventual Contraction or Transformation:

Because of their large weightings in index funds, these tech giants can drive the performance of the entire index. When these companies perform well, index funds, which many investors hold as a core part of their portfolios, also perform well.

As more of the market is concentrated in a few cash-rich tech giants, the overall market performance can sometimes give a misleading impression of broader market health, as gains or underperformance in these tech giants can mask weakness or strength in other sectors.

Overall, the dominance of cash-rich tech giants has contributed to a market that is increasingly influenced by a small number of companies, making it more challenging to assess the true state of the broader economy and market.

Using Tech Stars of the Past As Guides

Throughout history, there have been several instances where cash-rich companies or conglomerates exhibited behaviors similar to today’s tech giants, with significant impacts on the markets. Here are a few notable examples:

1. Standard Oil (Late 19th to Early 20th Century)

Background: Founded by John D. Rockefeller, Standard Oil became the world's first and largest multinational corporation and one of the most significant companies of its time.

Cash Rich & Dominance: Standard Oil amassed immense wealth through its near-monopoly on oil production, refining, and distribution in the United States. It used its cash reserves to buy out competitors, invest in infrastructure, and influence market prices.

Impact on the Market: Its dominance skewed the entire oil industry and had far-reaching effects on related markets, much like today's tech giants. Its monopolistic behavior eventually led to being sued by the United States Government in 1906 for violating the Sherman Antitrust Act. The Supreme Court ruled in favor of the government in 1911, mandating a breakup of Standard Oil into 33 companies, including what turned into some household names today. Standard Oil of California acquired Standard Oil of Kentucky and was renamed Chevron Corporation in 1984. Standard Oil Company New Jersey was renamed Exxon Corporation in 1972.

What Forces Reshaped It: Regulatory Lawsuits

2. AT&T (Mid-20th Century)

Background: AT&T, also known as "Ma Bell," was the dominant provider of telephone services in the United States for much of the 20th century.

Cash Rich & Dominance: AT&T used its vast cash reserves to maintain control over the telecommunications industry, investing heavily in infrastructure and acquiring smaller companies.

Impact on the Market: AT&T's dominance led to a lack of competition in the telecommunications market, similar to how tech giants dominate their respective sectors today. The company's monopoly on phone services was challenged by the U.S. government, leading to the breakup of AT&T in 1984 into several regional companies, which reshaped the industry.

What Forces Reshaped It: Regulatory Lawsuits

3. IBM (1960s-1980s)

Background: IBM, also known as "Big Blue," was the leading technology company in the mid-20th century, dominating the computer hardware and enterprise software markets.

Cash Rich & Dominance: IBM's cash flow from its mainframe business allowed it to invest heavily in R&D, marketing, and acquisitions, maintaining its dominance in the computing industry.

Impact on the Market: IBM's market power was so significant that it shaped the entire tech industry. However, the rise of personal computing in the 1980s and competition from companies like Microsoft and Apple eventually challenged IBM's dominance, leading to its decline in the PC market.

What Forces Reshaped It: Technological Shifts & New Competitors

4. General Motors (1950s-1970s)

Background: General Motors (GM) was the largest and most powerful automotive company globally, controlling a significant share of the U.S. car market.

Cash Rich & Dominance: GM’s substantial profits allowed it to invest in a vast range of businesses, including non-automotive ventures, and dominate the automotive supply chain.

Impact on the Market: GM's dominance influenced the entire automotive industry, similar to how tech giants affect today's markets. However, GM's focus on its core business and failure to innovate eventually led to significant challenges, culminating in its bankruptcy and government bailout in 2009.

What Forces Reshaped It: Internal Collapse & Failure to Innovate

5. Microsoft (1990s)

Background: Microsoft became the dominant player in the software industry, particularly with its Windows operating system and Office suite.

Cash Rich & Dominance: During the 1990s, Microsoft amassed substantial cash reserves from its software sales, which it used to maintain and extend its dominance, often through aggressive business practices and acquisitions.

Impact on the Market: Microsoft’s dominance led to antitrust scrutiny and legal challenges, most notably the U.S. government's antitrust case in the late 1990s, which accused Microsoft of monopolistic practices. The case resulted in a settlement that imposed restrictions on Microsoft’s business practices, though it remained a dominant player. It survived these changes to face competition from cloud services (AWS) and the rise of open-source software alternatives like Linux, followed by competition from emerging tech giants (Google, Apple) in mobile, search, and browser markets, and more recently generative AI.

What Forces Reshaped It: Regulatory Lawsuits, Emerging Tech Giants, and Technological Shifts

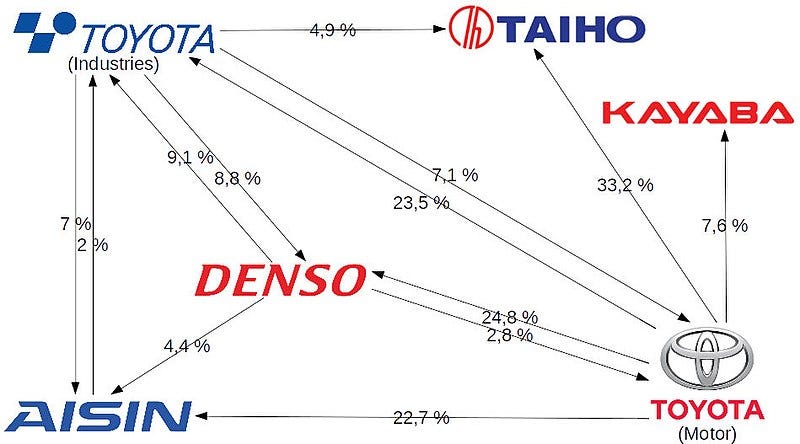

6. Japanese Conglomerates (Keiretsu, 1980s)

Background: During the 1980s, large Japanese conglomerates, or keiretsu, like Mitsubishi, Mitsui, and Sumitomo, became extraordinarily cash-rich and influential. The rise of keiretsu was fueled by strong relationships between businesses and banks, government industrial policies, and a commitment to long-term growth rather than short-term profits. Common shareholdings and support across the holding companies insulated them from outside competition, while Japan’s rapid industrialization and export-driven economy of the postwar period provided fertile ground for growth.

Cash Rich & Dominance: These conglomerates had vast financial resources and controlled significant parts of Japan's economy, from manufacturing to banking.

Impact on the Market: Their influence skewed the Japanese economy and global markets, as they invested heavily in real estate and other assets. The eventual bursting of Japan's asset price bubble in the early 1990s led to a prolonged economic stagnation, known as the "Lost Decade." Reforms aimed at increasing competition and reducing the close ties between banks and businesses contributed to their decline

What Forces Reshaped It: Market Shifts & Regulatory Changes

What Will Reshape Today’s Cash-Rich Tech Giants?

We continue to talk a great deal about the potential impact of interest rate cuts, but will they be enough to refuel the type of innovation we’ve seen power tech company growth for the past 10-15 years? Most economists don’t expect that level of low interest rates to return in such a sustained form so soon.

Instead we’re likely to see a combination of social shifts (generational changes as baby boomers retire and the lasting impact of the pandemic on norms like work-from-home policies), changes to financial plumbing (particularly as these could make access to credit more limited or mean cash-rich companies increasingly fund innovation elsewhere), and regulatory actions (antitrust, AI regulation, etc.) play a role, shaping which new entrants have the capital and technological power to compete with cash-rich tech giants or at least draw their attention. Cash-rich tech companies could turn their cash into fuel for new generations of tech superstars, as we’re seeing with generative AI companies like OpenAI and their relationships with Microsoft, Google, and Meta today.

Every post on the Volala Substack comes with its own party music. Let’s close this one out with Oasis’ 1996 hit “Champagne Supernova.”